Strategic Plan 2023-2025

A record investment to drive the energy transition

We announce an investment of 47 billion euros by 2025 to help create a secure and sustainable energy future.

At Iberdrola, we work with the purpose of building a healthy and accessible electrical energy model, based on the well-being of people and the preservation of the planet. The global crisis that arose in 2022 reaffirms our long-term vision and confirms the need for strong investment to end dependence on fossil fuels, which still covered 75% of energy demand in 2022. For this reason, the Iberdrola Strategic Plan 2023-2025 commits €47 billion to drive the energy transition through its various axes.

Strategic Plan 2023-2025 in figures

47,000

M€ total

27,000

€M investment in networks

17,000

€M investment in renewables

0

Net Zero in scopes 1, 2 and 3 before 2040

12,000

New hires

420

€M/year Investment in R&D

65-75

% pay-out of earning per share

80

% investments allocated to A-rated countries

A commitment to financial strength

Our roadmap between 2023 and 2025 looks to the future with optimism and commitment. We are advancing our global growth with a record investment plan based on the construction of more electricity grids and selective growth in renewables, accompanied by a commitment to new value-added solutions: the pillars to accelerate the electrification of all territories and sectors, including transport, industry and buildings.

The €47 billion plan increases our earnings forecast and financial strength to 2025 and maintains our 2030 outlook, based on our performance model of recent years. Growth supported by organic investments in all markets, of which 80% will be in A-rated countries, with clear and stable regulatory frameworks and ambitious electrification targets.

By the end of the decade, we expect to exceed €65 billion in network assets and 100,000 MW of installed capacity (more than 80% of it renewable), thanks to new investments of between 65 and 75 billion between 2026 and 2030. An investment effort that we feel responsible for in order to promote a safe, clean and competitive energy system that allows us to curb greenhouse gas emissions and climate change.

“The record global investment plans we have set out today will help us to bring more self-sufficiency and resilience against potential energy shocks in the countries where we operate, by reducing their dependency on oil and gas and by continuing their path to Net Zero”

Ignacio S. Galán

Iberdrola's Executive Chairman

Ten keys to building the energy of the future

We are committed to moving forward and preserving the planet.

More about our Strategic Plan

Smart grids for a decarbonised world

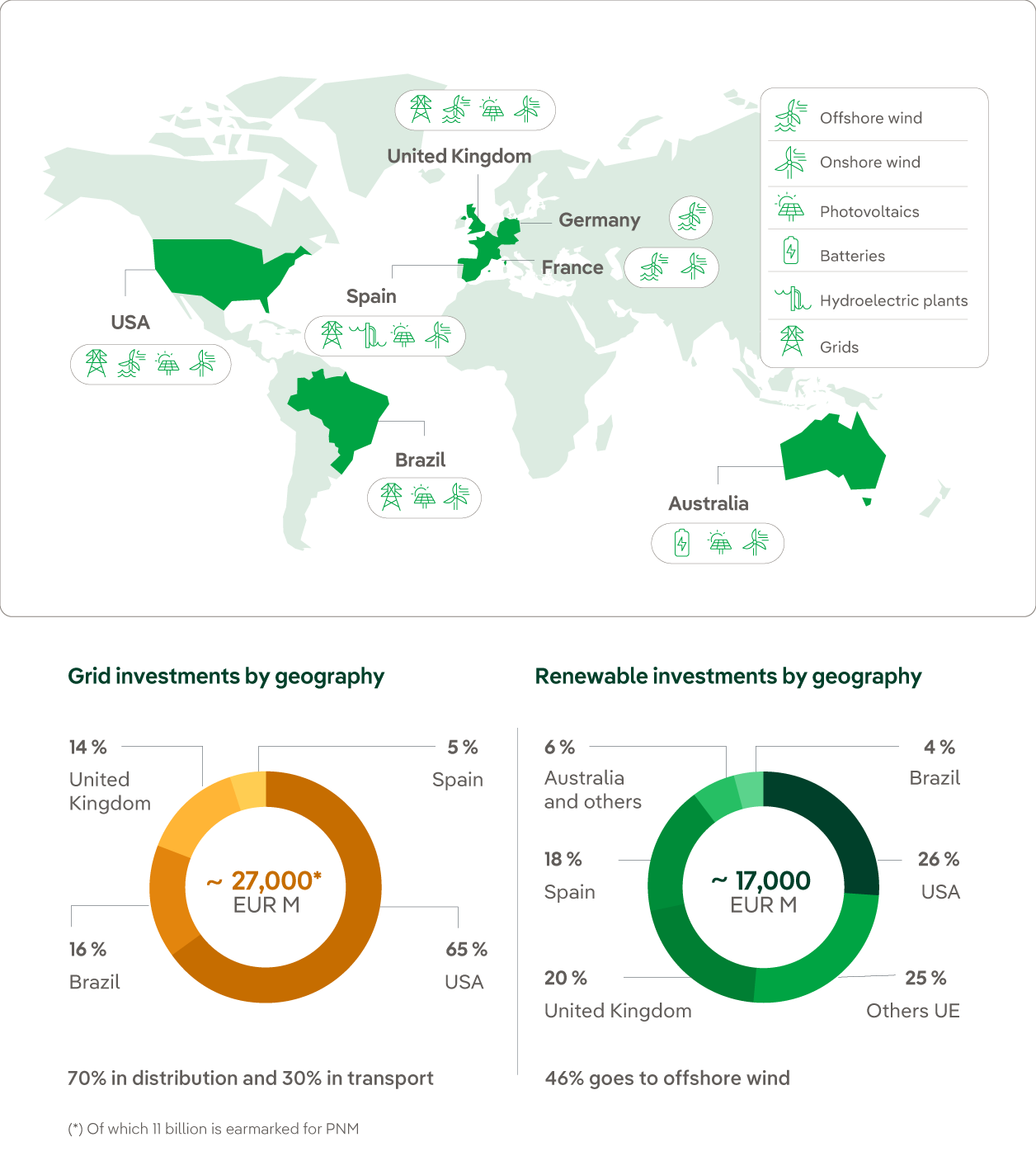

In order to support renewable energy development, it is not enough just to increase our installed capacity: smart grids are essential for our clean energy to reach consumers safely and efficiently in any country in the world. That is why our Plan devotes €27 billion to this area.

Smart gridsOffshore wind, key to our future growth

Almost half of the amount that our Strategic Plan dedicates to growth in the area of renewables (€17 billion) is focused on offshore wind projects in France, Germany, the United Kingdom and the United States. The next most important technologies are onshore wind (25% of investment) and photovoltaic (24%).

Offshore windEnvironmental, social and governance factors

All our investments underpin our contribution to sustainable development and are fully integrated with the ESG+F objectives, our sustainability roadmap to 2030. This makes us today one of the private sector companies with the most ambitious environmental targets: carbon neutrality and net positive impact on nature.

ESG valuesSmart grids for a decarbonised world

In order to support renewable energy development, it is not enough just to increase our installed capacity: smart grids are essential for our clean energy to reach consumers safely and efficiently in any country in the world. That is why our Plan devotes €27 billion to this area.

Smart gridsOffshore wind, key to our future growth

Almost half of the amount that our Strategic Plan dedicates to growth in the area of renewables (€17 billion) is focused on offshore wind projects in France, Germany, the United Kingdom and the United States. The next most important technologies are onshore wind (25% of investment) and photovoltaic (24%).

Smart gridsEnvironmental, social and governance factors

All our investments underpin our contribution to sustainable development and are fully integrated with the ESG+F objectives, our sustainability roadmap to 2030. This makes us today one of the private sector companies with the most ambitious environmental targets: carbon neutrality and net positive impact on nature.

Smart gridsSolutions to secure the future

At Iberdrola, we want to give added value to our customers, listen to their needs and make them a key player in the energy transition, whether they are residential or business users. For individuals, our proposals focus on solar self-consumption, electric mobility and green air conditioning. For industrial customers, we offer decarbonisation plans through air conditioning or green hydrogen.

We will allocate EUR 3 billion to other green products and clients

To reach 110,000 recharging points and 125,000 self-consumption installations

Leading green hydrogen production, with a project portfolio of 2,400 MW

Supporting industry on its path towards decarbonisation

To reach 110,000 recharging points and 125,000 self-consumption installations

Leading green hydrogen production, with a project portfolio of 2,400 MW

Supporting industry on its path towards decarbonisation

We invest in the care of the environment and of people

At Iberdrola, we are very aware of the need for our strategy and operations to always be aligned with environmental, social and governance (ESG+F) factors for socially responsible management.

In this way, we know that the €47 billion of the Strategic Plan will also contribute to our aim of making a positive impact on the well-being of people and the preservation of the planet. Some of our most important goals are:

We are making solid progress in the fulfilment of our Strategic Plan

By the end of September 2023, Iberdrola had already exceeded a good part of the commitments made in the Strategic Plan for 2025. This rapid progress in meeting the plan is the best demonstration of our ability to execute our plans ahead of schedule, even in the current challenging macroeconomic scenario.

In this context, the Group has already announced a date for the next Capital Markets & ESD Day on 21 March, 2024.

Of particular note was the early completion of the €7.5 billion Non-Core Asset Rotation Roadmap by 2025, within the first semester of 2023, as well as partnerships to co-invest with leading global funds, thanks to some important corporate transactions of the Group carried out in the first months of the plan's implementation.

Our investments of €10.842 billion in the 12 months prior to September 2023 also endorse the two areas we are committed to as priority axes for the energy transition. Thus, we achieved a 9% increase in the Networks asset base, to €41.3 billion, and an increase of nearly 3,100 MW in our renewable capacity, reaching almost 41,300 MW in total.

Around 90% of the energy planned for 2023-25 is already sold, which secures us long-term revenues. In addition, we have power purchase agreements or PPAs for the period 2026-30 for more than 230 TWh.

Featured documents

Consult here all the documentation published in the presentation of the Iberdrola 2023-2025 Strategic Plan during our last Capital Markets & ESG Day 2022.

Strategic vision

Presentation on the company's strategic vision for the coming years by Iberdrola Chairman Ignacio S. Galán.

Business positioning

Presentation on Iberdrola's 2023-2025 objectives and business prospects by Iberdrola's CEO, Armando Martínez.

Financial management

Presentation on Iberdrola's financial management by CFO José Sáinz Armada.

Leadership in Governance & Compliance

Presentation on Iberdrola's leadership in compliance and governance.

Cybersecurity governance

Presentation on Iberdrola's cybersecurity governance model.